Before taking a mortgage in Kenya, you should consider various factors. Mortgage is not something you’ll pay for a couple of years, it takes up to 30 years to complete. Mortgage is a good thing especially if you want to own a home. Instead of paying rent for 20 years, it’s better to take a mortgage, occupy the house as you pay monthly.

Below are factors to consider before taking a mortgage in Kenya:

- Your age

Since mortgage is a long term investment, it’s better to take it when you are young.Don’t take a mortgage when you are 55 –years-old. The right age is 20 to 45 years.

- Interest rate charged on the mortgage

The interest rate also matters. Make sure it’s fixed such that even if the bank or the financial institution adjusts its interest rate, it won’t affect your payment amount. The interest should be low and fixed.

- Payment duration

How many years will you pay the mortgage? Once you know, you’ll plan well your finances. Mortgage can drain you financially especially when you have other commitments.

- Stability of your job

Only permanent and pensionable people are ideal for mortgage facility. If you are working for NGO,it’s not advisable to take a mortgage because your job might end anytime. The same case applies to those working in the private sector.

Mortgages are mostly good for entrepreneurs and government employees

- Do you have plan B if your source of income disappears

Assuming that you are holding a government job and you are retrenched, do you have another way you can pay the mortgage? If you only depend on one source of income, you better buy land and build your own house than taking a mortgage.

- Type of company offering the mortgage facility

You should do background checks to determine the reputation of the company offering the mortgage facility. Ensure that the houses being sold to you are genuine. Ensure that the company has been in existence for decades. You don’t want a case where you pay for some years and the company disappears with your money.

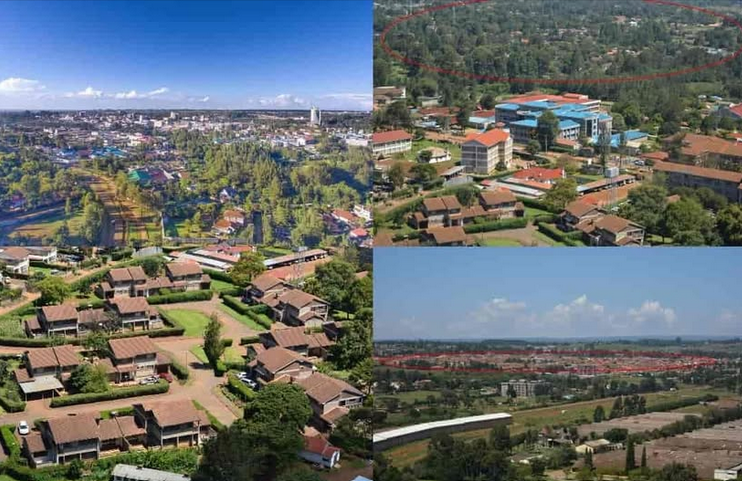

- Location of the house

The location of the house also matters. If you want comfort in an environment where there is comfort, move away from the town to outskirts. Since mortgage takes years, your house might be surrounded with apartments if it’s near town. This might not be pleasant to you.

- Price of the house

The price of the house will also determine whether you will take the mortgage or not. You don’t want to spend your entire life paying the mortgage and doing no any other investment.

- Your financial commitments

Are your finances committed elsewhere? If you have heavy financial responsibilities, don’t take a mortgage because you might get stressed.

- Are there cheaper alternative ways of owning a home?

Normally, mortgage is more expensive than buying land and building a house. Most people prefer building than buying a home. You should weigh out to determine whether it’s cheaper to build your house or to buy one through mortgage.