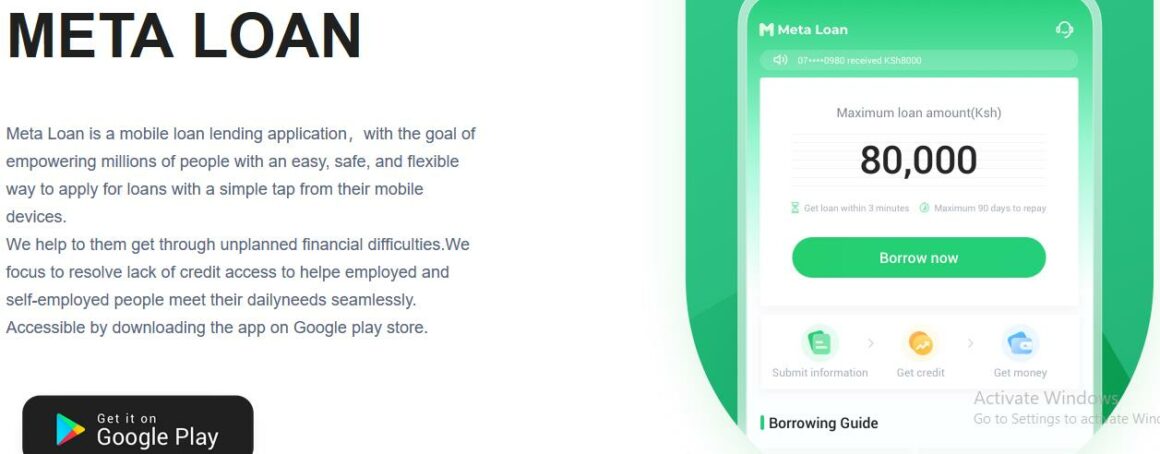

Meta Loan is one of the best loan Apps in Kenya which offers mobile loans to Kenyans. Loan amount is between Ksh 1,000 and Ksh 80,000. The loan limit is Ksh 80,000.

According to the App, when you take a loan, maximum repayment period 365 days and minimum days are 91.

Meta Loan annual interest rate is 48% or 4% monthly. If you take a loan of Ksh 10,000, you will pay interest of Ksh 4800 per year.

How to apply for the loan

- You should be a Kenyan Citizen

- You should be aged 18 to 60 years

- Download Meta Loan App

- You should have a Safaricom phone number

Once you download the loan, sign up and apply for the loan. During your first application, you are likely to get a loan of Ksh 1,000. The loan will be sent to you via Mpesa

Meta Loan Mpesa Paybill Number and how to apply for the loan

Meta Loan Mpesa Paybill Number is 733555. This is the number to use when repaying your loan.

How to repay your loan

- Go to Mpesa

- Select Lipa Na Mpesa

- Select Paybill

- Enter Business Number (733555)

- Enter Account (Your Mpesa phone number)

- Enter Amount

- Enter Mpesa Pin and send

Meta Loan Customer Care Contacts

Telephone: +254 709536300 / +254 709462900

WhatsApp: + 254 769575341

Email: help@metaloan.co.ke

work with us: help@metaloan.co.ke

You can contact the company through calls, WhatsApp, Facebook or chat on their website. There is also the option of sending an email.

What if you don’t repay your loan in time

In case you fail to repay your loan in the stipulated time, you will pay a penalty and if you default, Meta Loan will submit your details to CRB. But make sure that you have repaid your loan in time to avoid being listed in CRB.Late loan repayments automatically incur a late fee of 2.5% per day

How to increase loan limit

Your loan limit might be stuck at Ksh 1,000 but it’s possible to increase it to even Ksh 80,000. The first thing to do is to ensure that you don’t default any of your loans. You should also take the loan consistently—apply for another loan immediately you finish repaying the current loan.

If you consistently apply for the loan and repay for one year, your limit will be increased to even Ksh 80,000.

You should also apply for maximum available loan each time you apply for the loan.

Advantages of the loan

- It’s readily available

- No collateral required

- Easily awarded—no bureaucracies

- Loan limit increased fast

Disadvantages of the loan

- High interest rate

- You can be listed with CRB, hence deny you opportunity to get loans from other Apps

- It can lead to addition and spending of the money on irrelevant things

Meta Loan Reviews from customers

“I downloaded the app the process was fast. However the loan interest is too high and the repayment period too short so I decided to delete my account, but they refuse to send the verification code to my number inorder to confirm account deletion. It’s a fishy way to keep a client in your records. I haven’t borrowed and will not. Please send the verification code so that I can proceed to delete my account!!!”

“This is the best loan app ever with reasonable interest, easy disbursement and also gives enough time to pay up.i recommend this app for anyone looking for a reliable loan app. Their registration is very easy and efficient also they are ready to meet up to you at anytime of your needs unlike other apps that get’s all your information but at the end won’t give you anything.keep up the good work meta loan you are the best!!!”

“I took Ksh 3,000 loan from your App and the interest was too high. You should reduce the interest on the loan, otherwise other things are good.”