Below is a list of accounts offered by Premier Bank Kenya and loans.

Current Accounts

Personal Current Account

Enjoy the freedom and flexibility in managing your transactions. This account is perfect for everyday banking!

Key Features & Benefits:

- Opening Balance Kes 1,000/-

- Access to Debit Card

- Access to financing

- Access to a Cheque book

- Free internal account transfers(with Cheque Leaf)

- Access to Internet banking

- Free counter withdrawal (with Cheque Leaf)

- Available in KES or USD, EURO, GBP for foreign currency account

Salary Account

Key Features & Benefits:

- Opening & Operating Balance KES 500

- No Cheque Book

- Access to VISA debit card

- Counter withdrawal of KES 240 per transaction

- Access to mobile banking and Internet banking

- Free internal transfers

- Available in KES ONLY

Ufanisi Chama Account

Are you an investment group, or a Chama with a common agenda to accumulate savings for investments or facilitating small to medium investments? This is the account for you! This account allows chamas to collect money and have access financing.

Key Features & Benefits:

- Opening and operating balance KES. 1,000

- Free monthly statements

- Banker’s Cheque

- Cheque Book

- Account maintenance fee of Kshs 100/-

- Free internal transfers

- Available in KES

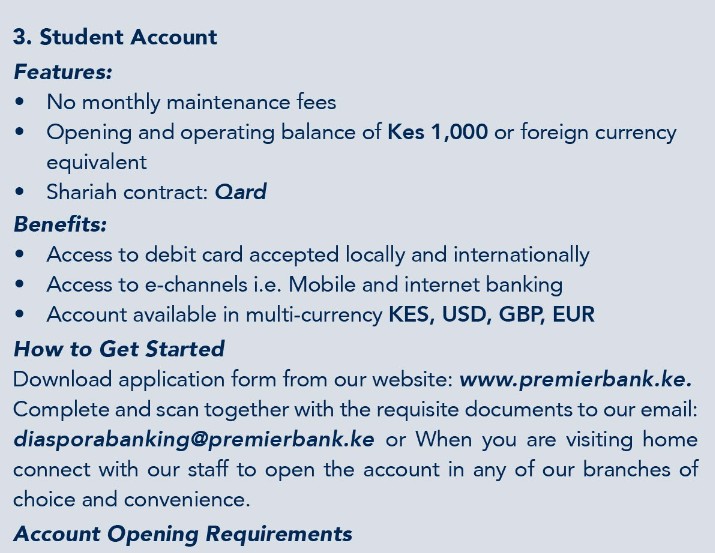

Student Account

An account that promotes a saving culture among the youth by teaching them financial management through saving. This account is specifically designed for students mostly University/college students.

Ufanisi Binafsi Account

The Ufanisi Binafsi Account is a pay as you go account tailor-made for small Scale Entrepreneurs and sole proprietors who are trading either as themselves or using a business name.

Key Features & Benefits:

- Opening and operating balance KES. 200

- Free monthly statements

- Zero account maintenance fee

- No chequebooks

- Access to Visa Debit card

- Free internal transfers

- Available in KES

- Access to Banker’s Cheque

Savings Accounts

Savings Accounts

We offer you a convenient way to start your savings journey!

Our high Profits rates allows you to relax and let your hard earned money work for you, turning your dreams into a reality

Benefits:

Attractive Profits margins:

Let your money work for you with our competitive Profit rates. Save more! Earn more!

Free Deposits

Open your savings account from as little as KES 1000

FREE E-statements

For accountability, you will receive free statements quarterly

Pro-savings

Restricted free withdrawals allowed per month to encourage the saving culture

Busara Account

Busara account allows you to save for the rainy days as you also earn profit share. This is an account tailor-made to help customers grow their savings by keeping aside some money every month.

Key Features & Benefits:

- Opening and Operating Balance KES 5,000

- Maximum of 2 free withdrawals per month. (over the counter charges apply thereafter)

- Access to Bankers cheque

- Free Semiannual statements

- Available in USD, KES, EURO, GBP

- Zero account maintenance fee

- Expected profit earned monthly on average balance above KES 5,000

- Attractive profit share

Young Community Savers Account

It’s never too early to secure your child’s future; start their saving journey with our Young Savers Account. Encourage your child’s saving habit with our convenient and secure Young Savers Account.

Key Features & Benefits:

- Opening balance KES 1,000

- Expected Profit earned semi-annually on average balance above KES 5,000 –Profit distribution twice yearly

- Free monthly statements

- 3 free banker’s cheques for tuition fees per annum

- Free internal transfers

- Zero account maintenance fee

- Free home bank

- Kiddie events

Labbeyk Account

This account is specially designed for individuals who want to save to go for Hajj.

- Opening and operating balance KES 1,000 or equivalent

- Free Semiannual statement

- Expected profit earned monthly on average balance above KES 5,000.

- Free internal transfers

- Available in USD, KES, EURO, GBP

Business Accounts

Biashara Current Account

This account covers your everyday business banking needs to help your business stay ahead of the curve. Tailor-made for SME’s & Sole Proprietors.

Key Features & Benefits:

- Minimum Operating balance KES 2,000/-

- Online Banking platform

- Preferential pricing on banking transactions

- Access to cheque book

- Comprehensive suite of products & services

- Our dedicated call center for all your enquiries

- Global access to all Visa ATMs and Merchants through our Visa debit cards

- Free internal transfers

- Free Monthly statements

- Available in KES or USD/GBP/EURO for foreign account

Corporate & Institutional Banking

Suitable for;

- Large Corporations: Let’s address your complex business challenges with our comprehensive business advisory services.

- Multinational Companies: Unlock your full potential with our innovative products, services and Industry Expertise.

- Financial Institutions: Leverage on our regional network and innovative technology for a seamless risk averse cross financial solutions.

- Government Parastatals: Create new opportunities for your organization, community and individual you serve.

- Non-governmental Institutions

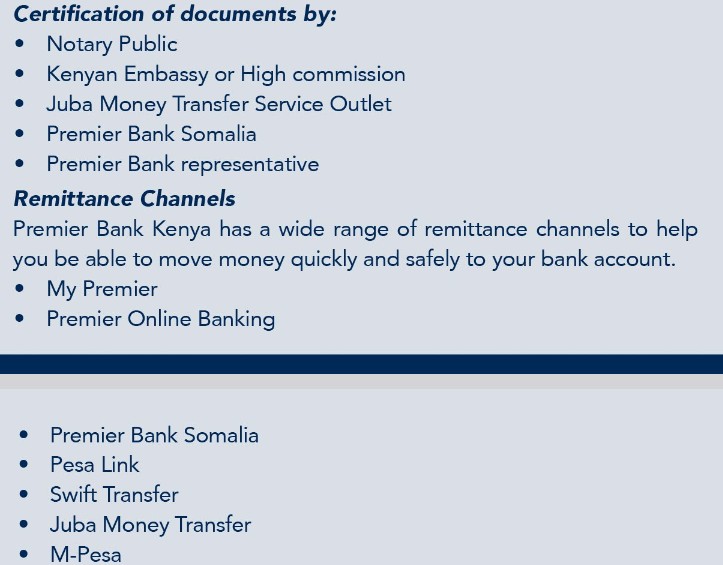

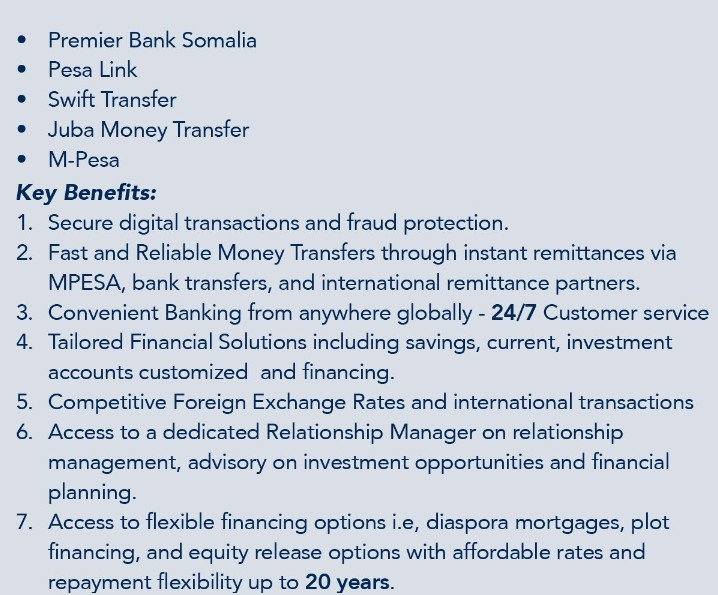

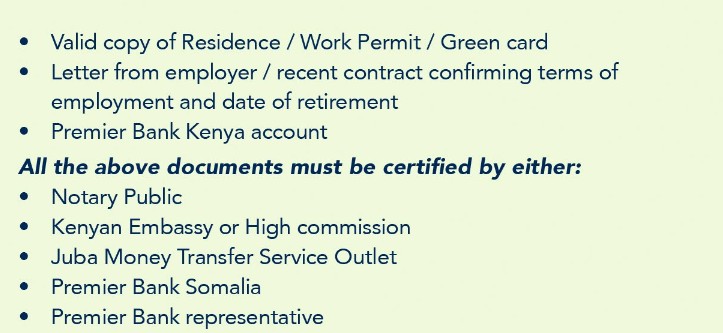

Diaspora Banking Accounts

Premier Bank list of loans

Checkoff Facilities

Features

- Available to customers whose employers have MOUs with the Bank

- Limit of up to Kes. 5,000,000/=

- Maximum repayment period of 7 years

Unique Selling Points

- Flexible security requirements (Salary Assignment)

- Quick Turnaround Time

- Affordable Rates

Construction Financing

Unique Selling Points

- Quick Turnaround Time

- 100% rebate on early payment

- Affordable Rates

- Flexible security requirement

Medical Expenses & School Fees Financing

Features

- Available to all account holders

- Payment is made directly to hospital/school

- Maximum repayment of up to 1 year

Unique Selling Points

- Flexible security requirements

- Maximum repayment of up to 1 year

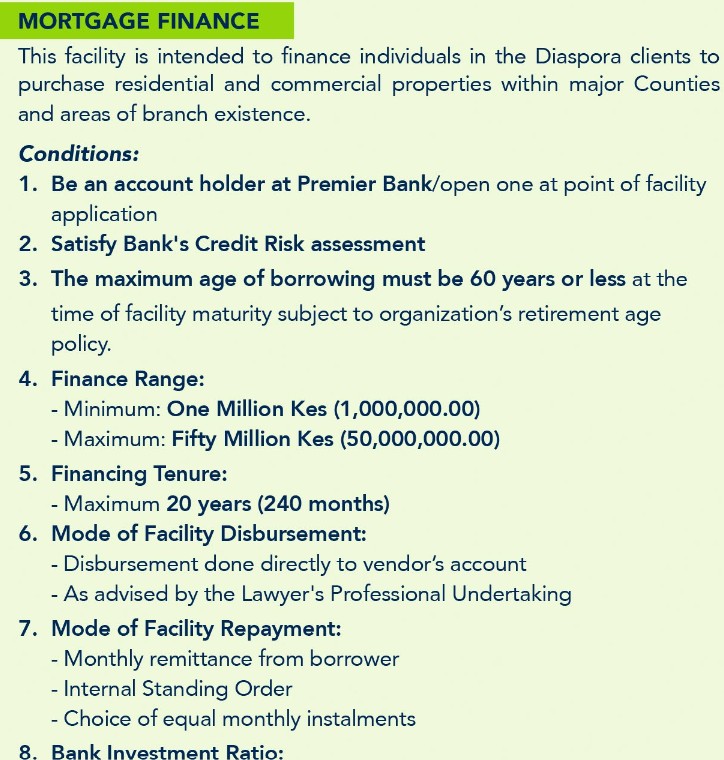

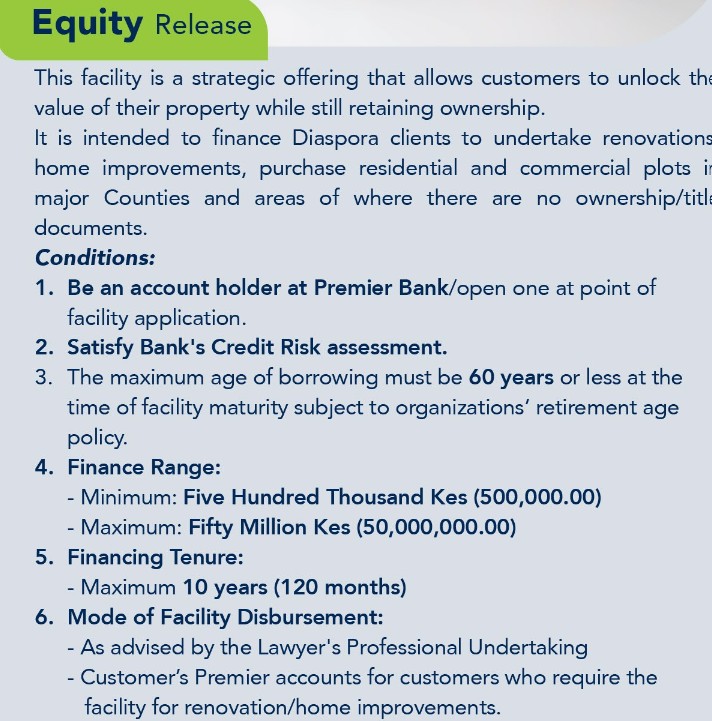

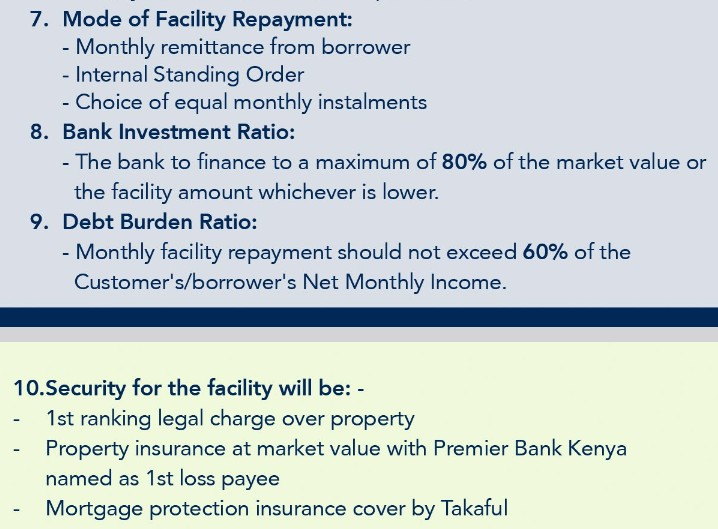

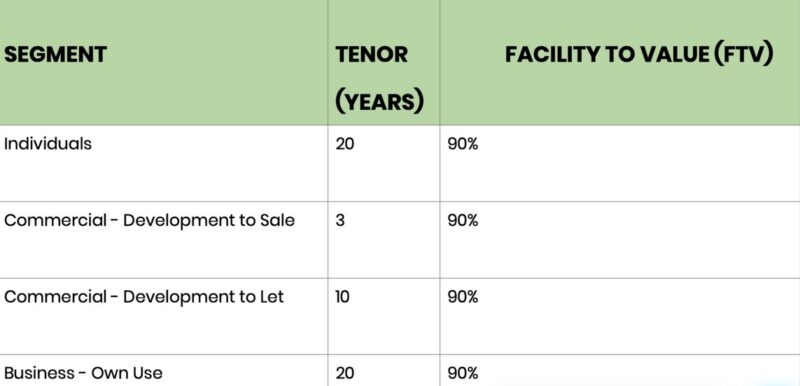

Mortgage Financing

Buying or Building? We got you covered. Take advantage of our affordable home financing today!

Features

- Repayment period will be up to 20 years for both personal and business

- Bank financing will be up to 90%

Unique Selling Points

- Quick Turnaround Time

- 100% rebate on early payment

- Affordable Rates

- Flexible security requirement

Motor Vehicle Financing

Unique Selling Points

- Quick Turnaround Time

- 100% rebate on early payment

- Affordable Rates

- Flexible security requirement

Personal Financing – Household Items and Construction materials

Get a new financing or top up existing facility with our flexible terms, quick processing and affordable profit rates.

Features

- Available to all salaried account holders

• Payment is made directly to the vendor’s account

• Maximum repayment of up to 1 year

Unique Selling Points

- Flexible security requirements (Salary Assignment)

• Quick Turnaround Time

• Affordable Rates

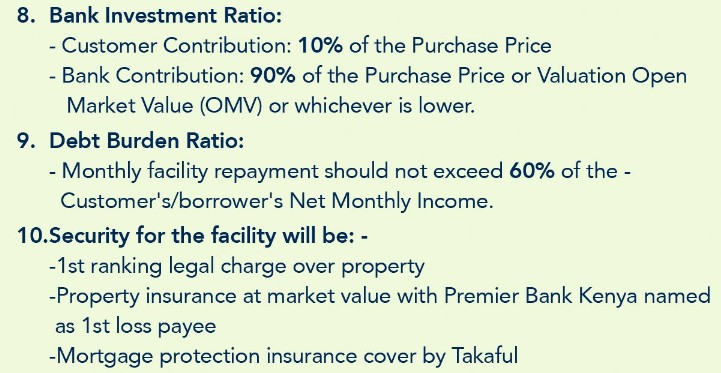

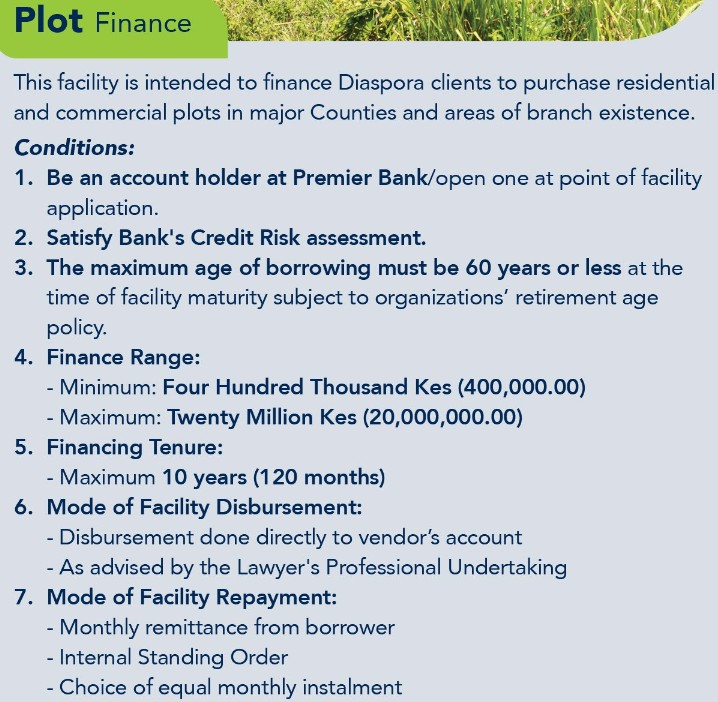

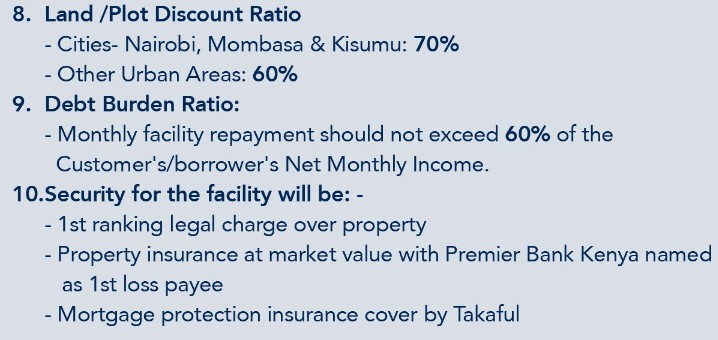

Plot/Land Financing

This is to help you acquire a piece of land.

Features

- Repayment period of up to 10 years

- The following are the discount amount:

Unique Selling Points

- Quick Turnaround Time

- 100% rebate on early payment

- Affordable financing rates

- Flexible security requirement

Working Capital

Whether you’re exporting or importing products, we understand that your business goals include generating revenue growth and getting higher profits. Focus on your operations as we take care of your financing.

Working Capital

Features

- Available for up to 36 months

- Contract terms agreed beforehand

Unique Selling Points

- Quick Turnaround Time

- Affordable Rates

- Flexible security requirement