“I have been working for a hardware shop in Nakuru and my salary was Ksh 25,000. This is what I always budget for. Last month I had applied for a job in Industrial Area Nairobi which I was referred by a former college mate. I got the job and am now expected to report. They told me to report o 1st November. My problem is that I am not used to handling a lot of money. I am going to earn Ksh 85,000 per month. All I need is advise on how to spend the money wisely”

Answer

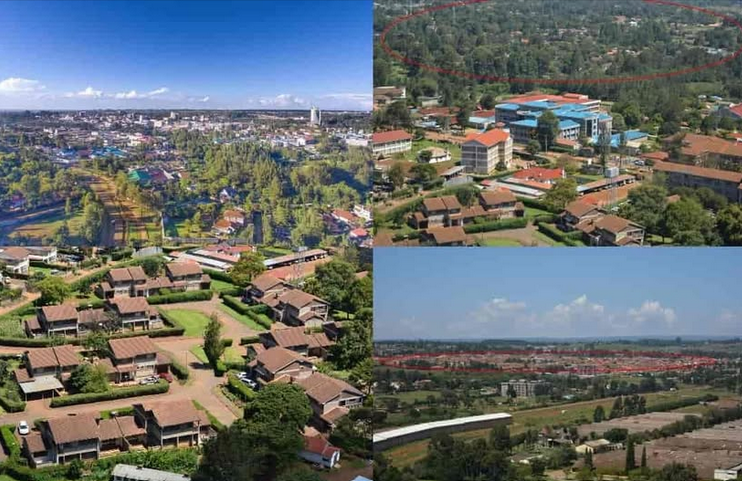

A salary of Ksh 85,000 in Nairobi is not much. Working in Industrial Area means that you live in Eastlands. Embakasi, Donholm, Tassia and Umoja are the ideal estates to rent a house in. Your monthly rent should not exceed Ksh 12,000. If you are single, rent a bedsitter and pay Ksh 8,000 to Ksh 10,000 rent. After sorting the issue of rent, you will now remain with the issue of transport and food.

Assuming that you rent a room in Embakasi or Donholm or Tassia, your monthly transport will range between Ksh 5,000 to Ksh 7,000. Food and shopping will cost Ksh 15,000. The total expenses will be Ksh 30,000 to Ksh 35,000.

Remember that your Ksh 85,000 is taxed. After deducing tax and other deductions like NSSF, you will remain with Ksh 68,000. This is the money you will budget for.

Since expenses will cost Ksh 35,000, deduct this money from Ksh 68,000. You will remain with Ksh 25,000 to Ksh 30,000 to save.

How to save Ksh 25,000

Open an account with a Sacco and save Ksh 10,000 monthly. At the end of the year, you will earn dividend of 12% to 18% of your savings. You will remain with Ksh 15,000. Open a Money Market Fund account and save the Ksh 15,000 monthly. All the MMF pay interest of 11% to 18% per year on your savings.

The good thing about Money Market Fund is that your money is safe. You will save without worrying about anything.

As you earn, avoid rushing to buy a car. Owning a car will increase your expenses.

You should also avoid destructive habits like having many girlfriends, gambling and alcohol.