Most people get rich at 20s and become poor at 30s because of many reasons. There are millions of people who have found themselves in this situation—and they never recovered. At 30s when they are mature enough is when money disappear and they start again from zero.

- Poor investment decisions

Majority of people in their 20s don’t have knowledge and experience on how to invest their money. Once they get money, they invest in assets which are not profitable. They will buy shares from collapsing companies, land which has cases or dead assets like building a very expensive house in the village. Such decisions eat into their savings, leaving them broke.

- Loans

Most youths take loans to expand their businesses. Such loans come with high interest rates and strict rules. After failing to pay in time, the financiers sell the assets to recover their money. You are left with nothing.

Millionaires at 20s should avoid mobile loans, loans from microfinance and shylocks. Such companies once they discover you are a millionaire, thy will adjust their interests upwards as you pay. One will take a loan of $10,000 and end up paying $100,000.

Some youths take loans to expand their businesses rapidly, ending up registering huge losses, hence closure of the businesses.

- Court cases

Majority of youths, especially men start sleeping around with women, ending up with children who they cannot provide for. The women go to court to force the man pay for upkeep. The man is threatened with dire consequences by the court incase he doesn’t obey the court orders. Consequently, he loses focus and his fortune.

- Living beyond their means

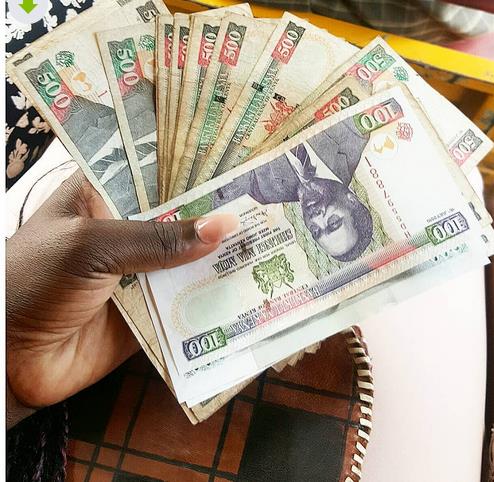

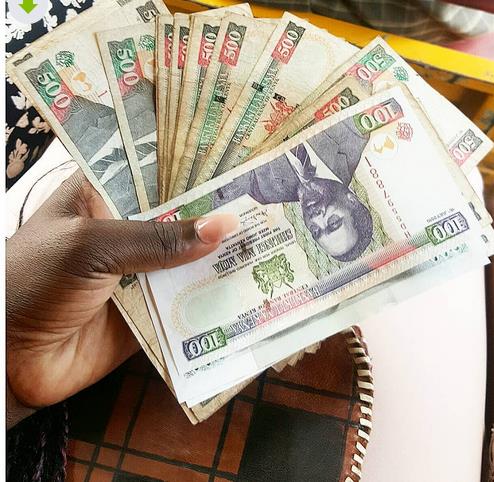

Youths at this age have not earned huge amounts of money before. When they get money, they buy big luxury cars, move to high end estates. They buy expensive jewelry, fly in hired choppers. All these things will consume most of their hard earned money. They don’t leave money for stocking their business. By the time they turn 30, they are already broke.

- Alcohol and other drugs

People below 20 years are normally under the care of their parents, where they can’t dare to take alcohol due to restrictions. After getting money at 20s, they resort to drinking expensive alcohol. This habit is facilitated and accelerated by bad influence.

Alcohol will slow your progress, kill your energy and eventually see you losing your cash. Though there are people who take alcohol and maintain their millionaire status, the number is significantly small.

- Lack of innovation and diversification of income

The millionaires in 2020 rely only on the business which made them millionaires. Perhaps when they were starting, there was no competition and the business was booming. But as time goes by, competition become stiff and the business lose its market share to competitors. Since you were used to a certain lifestyle, you refuse to downgrade your spending habits. Eventually, you end up closing the business.

You actually need to reinvent yourself, diversify your sources of income to cover for any financial shocks. Adopt new technology to cater for the need of technology savvy customers.

- They don’t have passive income

Without passive income, you won’t be sure of your financial status in future. Most youths forget about building ventures that earn passive income. They also don’t invest in passive income segments.

In your 20s if you invest in bonds, stocks, money market and real estate, it’s hard to lose your financial status in your 30s.

- Lack of maturity to handle money

At 20s most people are not mature enough to handle money, they would want to show everyone that they are rich by spending lavishly. They contribute in every function, they give money to people carelessly.

If you are keen, you will notice that rich people are stingy, they only give money to people who desperately need it and can be of value to them. A generous millionaire never lasts.

- Bad employees

Employees can either make you richer or poorer depending on how the business is run.As the company expands, you employ more people to run it.Since they are paid, you sit back and leave them to run it.By the time you notice that something is wrong, you have lost the company.

Employees will cook books of accounts to show that the company is doing well, when it’s collapsing.

You need to employ professionals who will help your company grow.