Platinum Credit is among the leading microfinance institutions. It offers different types of loans. Among the loans include:

- Check off loan

- Wezesha Express

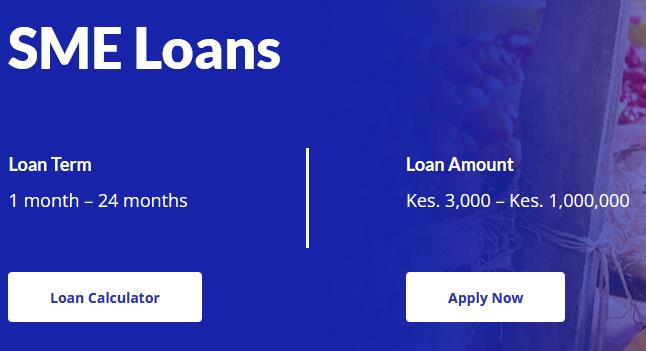

- SME Loans

- Landlord Loans

- Import Duty Financing

- Direct Import Financing

- Dairy Financing

- Insurance Premium Financing

- Stock 24/7

However, Kenyans would want to know the interest charged on these loans.

We have conducted a survey among Kenyans who took loans from Platinum Credit to know how much they were charged.

Moses

“I took a Logbook loan of Ksh 500,000 from the institution in 2021.I used my Toyota car. Repaid the loan for 2 and half years. In total,I paid Ksh 900,000.The problem is that they kept shifting goal posts and coming up with outrageous charges.I was to pay Ksh 720,000 but ended up paying Ksh 900,000.

Despite completing the payment, they refused to give me the logbook until I involved a lawyer. I got the logbook back in January 2024”

From Moses’s experience, it’s clear the interest on the Logbook loan was 80%.

Wangari

“Mine was SME Loans.My business was growing and I wanted to expand it.I have a friend who works there, he encouraged to take a loan from them.They requested for my ID,MPESA statement and current passport photo.I was also required to provide details of my guarantor. After giving them the documents, they gave me a loan of Ksh 600,000 which I was to pay for 24 months.

I repaid the loan for 24 months and in total,I paid Ksh 850,000.

Their online loan calculator doesn’t work. Once you start repaying, they increase the interest every time”

From Wangari’s experience, it’s clear she paid an interest of 41.7% on the loan.

From their online loan calculator, their interest rate is 12% to 20% but after paying, you’ll realize that the interest is 20% and above.